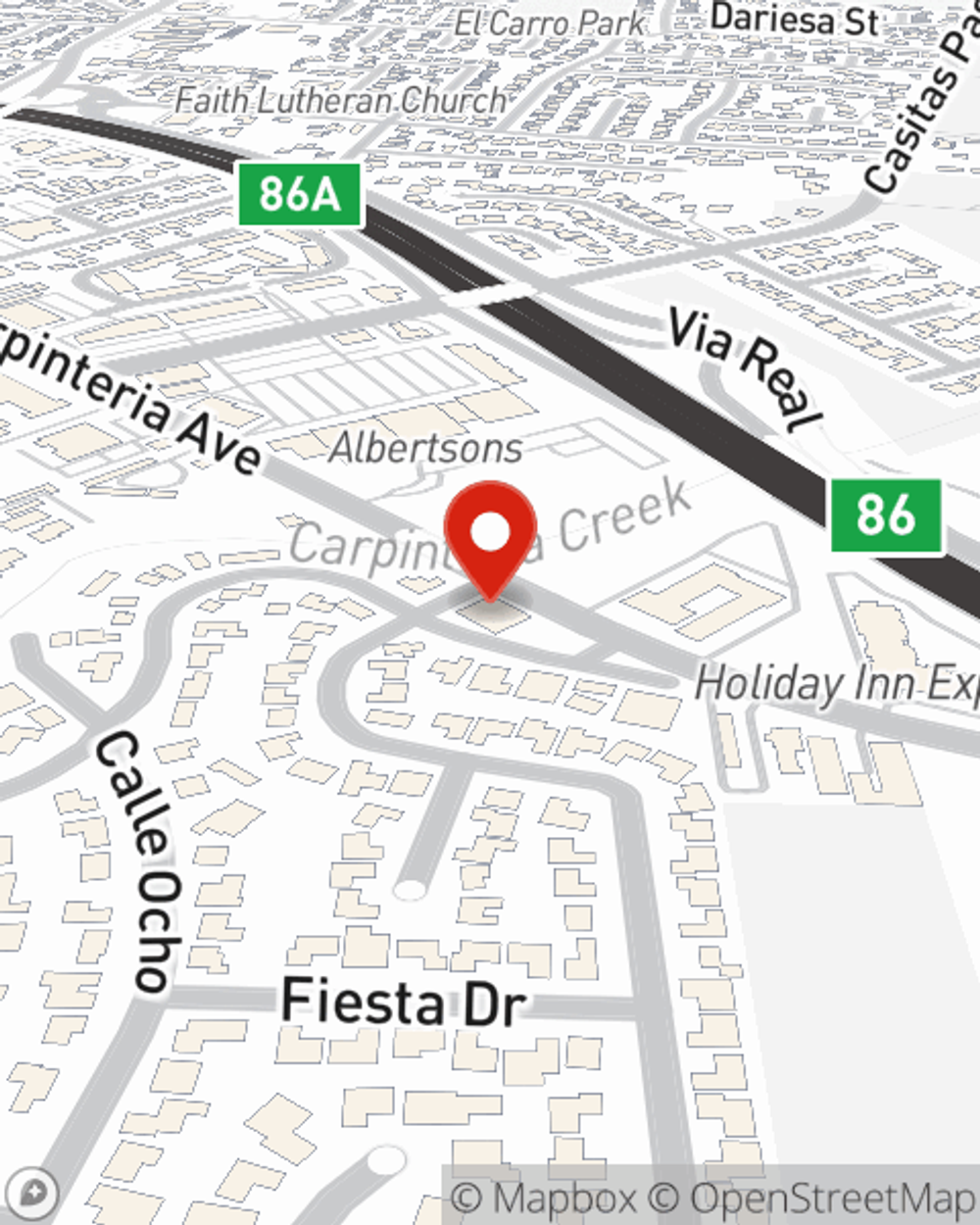

Business Insurance in and around Carpinteria

One of the top small business insurance companies in Carpinteria, and beyond.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

When you're a business owner, there's so much to take into account. It's understandable. State Farm agent Richard Campos is a business owner, too. Let Richard Campos help you make sure that your business is properly insured. You won't regret it!

One of the top small business insurance companies in Carpinteria, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

If you're looking for a business policy that can help cover business property, business liability, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Call or email State Farm agent Richard Campos today to explore how one of the leading providers of small business insurance can safeguard your future here in Carpinteria, CA.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Richard Campos

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.